Zimpler at a glance.

We are

people in the team.

We have

stunning offices.

We speak

different languages.

We’re on

diverse continents.

Our vision.

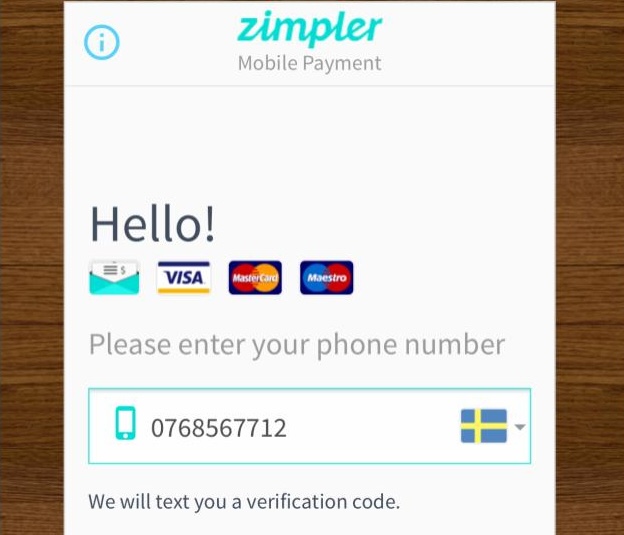

We are here to outsmart every barrier so that moving money is as simple as sending a text. We are here to make safe and instant transactions available between everyone, everywhere – all the time.

We are here to globally democratize payments.

Our mission.

We will get there through game-changing innovation and strong partnerships. We will drive the shift from outdated payment methods to state-of-the-art financial solutions.

We will reshape the financial industry.

Our brand values.

Meet our fundamental beliefs, the driving force behind everything we do. This is what we’re hellbent on delivering on, serving as a promise to you. This is what you should expect of us, always.

Creativity

We solve problems with fresh thinking, always finding a way forward. Even if it means we have to invent a completely new one.

Brilliance

We deliver outstanding solutions with meaningful impact. Our partners and customers won’t settle for less, and neither do we.

Grit

We dare to fail, because that’s the only way to learn and grow. We conquer challenges, maintain focus, and keep driving positive change.

Devotion

We go above and beyond to deliver truly exceptional service and value for our customers. We rather exceed than meet expectations.

Leadership.

It all started with a simple “why”.

The start of something great. By this time, mobile payment solutions and BankID weren’t a thing. Johan Friis and Kristofer Ekman Sinclair started PugglePay to simplify digital payments by using your phone number – one of the few numbers you know by heart.

A time of discovery. We developed our invoice solution and moved our base of operations from a tiny apartment to Chalmers University of Technology.

Mobile first. By this time, the market was all about mobile transactions, and we aimed to be “the preferred mobile payment solution in the Nordics”. We entered Finland and opened our first office on Regeringsgatan 11 in Stockholm.

Focus on safety. We took KYC and customer identification to a whole new level by enabling our product to identify the owner of a phone number – allowing safe payments. At the same time, a new service in the same industry was taking hold: BankID.

Big shift. PugglePay became Zimpler, and we launched our e-wallet. “We are a wallet without the negative aspects of a wallet” we said and went live in Germany. We signed increasingly significant customers, setting bigger things in motion. Cards were still 90% of the volume in the industry, but instant bank transfers started taking off across the board.

Major milestone. We received our current license from Finansinspektionen (the Swedish Financial Supervisory Authority) in the middle of a board meeting. “One of the greatest days of my life, still to this day” notes our founder Johan Friis.

Third and last pivot. We shifted focus from the e-wallet and launched our first A2A (account-to-account) product in our core markets, Sweden and Finland, aiming to “provide the best payment experience in Europe”. To top it off – Deloitte awarded us 3rd fastest growing company in Tech Fast 50 Sweden.

Ramping up. Our focus on A2A deepened, and we put massive effort towards the implementation and impact of PSD2. We poured all of our conversion skills into direct bank payments, and our growth started to pick up.

Focus time. We crystallized our offer to focus solely on A2A. No more e-wallets, no more invoices. “Buy now, pay later” became “buy now, pay now,” and this made our growth skyrocket. We took a new strategic investment round to accelerate it even more.

A change at the helm. Johan Strand, who joined as Chief Financial Officer in 2016, took over the CEO title. At the same time, we tripled our employees to 90 people and entered the Baltic region.

We celebrated the opening of our office in sunny Malta, our first base outside Sweden and shed our skin to reveal a new brand. We start eyeing cross-Atlantic expansion, ready to explore Latin America, while Nordstjernan comes on board as a shareholder.

GP Bullhound and Viva Technology listed us as one of the most promising scale-ups in Europe. At the same time, we finally opened our first office across the Atlantic – in vibrant São Paulo, Brazil.

The next chapter in our story is yet to be written. But we know one thing for sure – the future is Zimpler.

Nothing great ever happens in your comfort zone.

We believe in equal growth opportunities for all, and we want to be the best at providing them. For our customers, yes, but also for every single employee.

We know that no matter what the product is – the more identities and experiences working on it, the more who will enjoy it. When it comes to both market share and inclusion, less is not more.

So step out of your comfort zone and join us on the other side.